Audit Assertions for Purchases

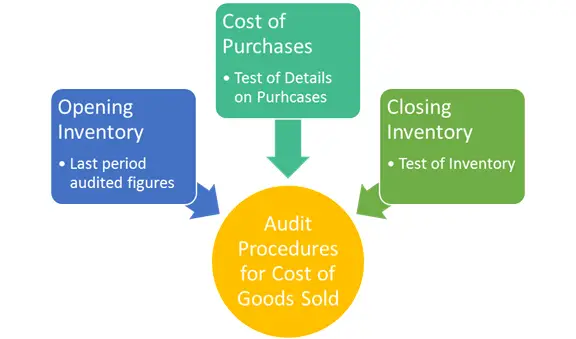

See page 64 and Chapter 16 of the notes assertions relate to classes of transactions eg. As auditors we usually audit inventory by testing the various audit assertions including existence completeness rights and obligations and valuation.

Auditing Cost Of Goods Sold Risks Assertions And Procedures Audithow

These are compliance requirements that are subject to the compliance audit.

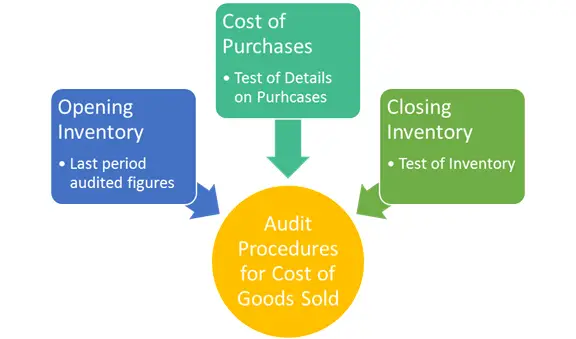

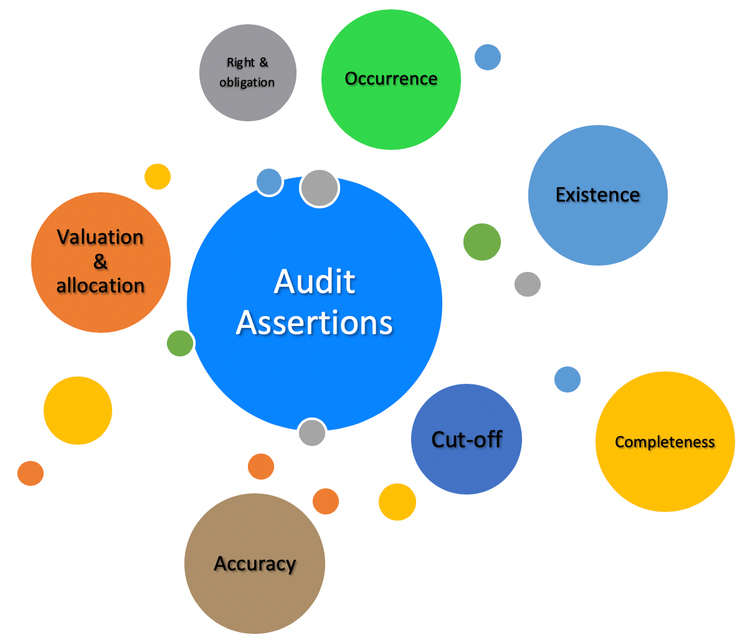

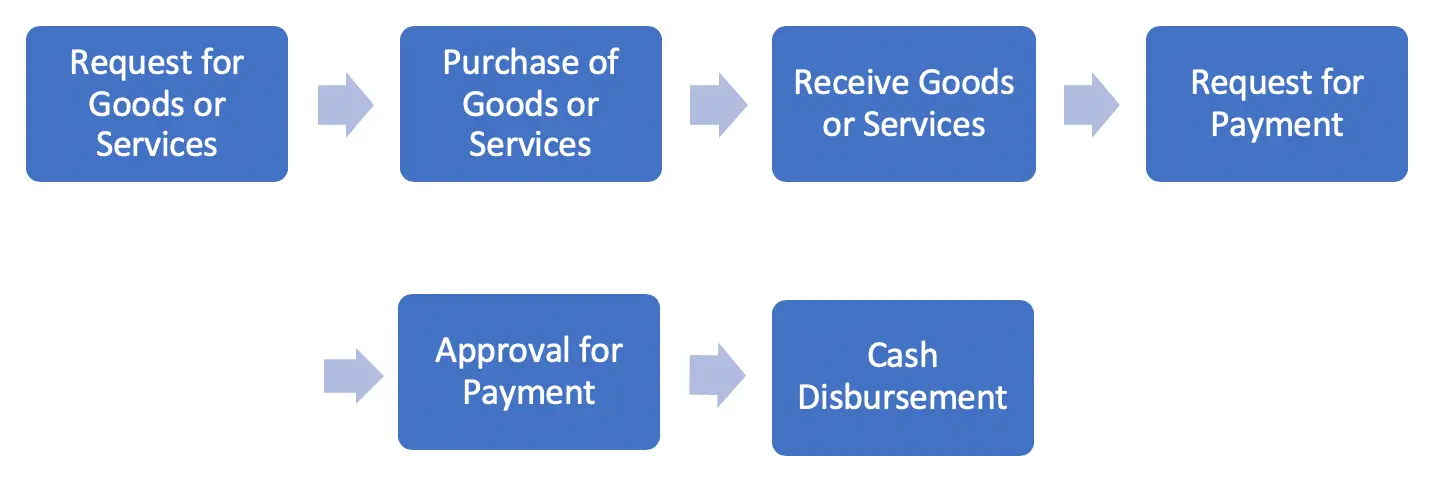

. Opening Inventory Purchases Closing Inventory. Whilst the procedures are perhaps similar in nature their purpose and relevance is to test different assertions regarding inventory balances. Typically we perform the audit of accounts payable in conjunction with the audit of purchases.

So my RMM for these assertions is usually moderate to high. 8 Audit Risk describes audit risk and its components in a financial statement audit the risk of material misstatement consisting of. For a detailed list of accounting audit definitions see PCAOB document AU 801.

Subpart 522 sets forth the text of all FAR provisions and clauses each in its own separate subsection. Confirms sales values and purchases costs ie. Put the relevant assertions next to each audit stepthis makes the connections between the RMMs at the assertion level and the audit steps clear.

Income Statement Formats are the Pro-forma for the presentation of an income statement which shows the result of the organization for the period ie. Thus in this section we will take some assertions that we usually test in. Collectively all classes of transactions account balances and their related disclosures make up the financial statements.

When control risk is assessed as low for assertions related to payroll substantive tests of payroll balances most likely would be limited to applying substantive analytical procedures and A. When the office supplies are utilized during the month an audit adjustment entry will be made to credit prepaid office. Definition of Income Statement Formats.

Information that the auditor must report as part of a prescribed audit. B Numbering 1 FAR provisions and clauses. If we disregard stock purchases and sales equity is usually the accumulation of retained earnings.

This could be the result of intentional fraud or. And retained earnings comes from the earnings or losses on the income statement. Sales purchases and account balances eg.

Footing and crossfooting the payroll register. Observing the distribution of paychecks. Inspecting payroll tax returns.

Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104. The purchases amount is taken from the purchase ledger while the closing inventory is calculated at the year end. The audit risk for Cash Disbursements is generally low but it also heavily depends on how well the entitys internal control policy is.

These aspects of audit risk are sampling risk and nonsampling risk respectively. Prepaid expenses are known as assets that are being paid for and then used gradually during the accounting period ie office suppliesA company purchases and pays for office supplies and as they are consumed they will become an expense. For an auditor to be reasonably assured of the Cash Disbursements made by the entity tests will be performed to cover the audit assertions.

Substantive procedures are the method or audit tests designed by an auditor to evaluate the financial statements of the company which require an auditor to create conclusive evidence for verifying the completeness accuracy existence occurrence measurement and valuation audit assertions of the financial records of the business. The opening inventory is the closing inventory of the preceding year and the amount can be extracted from previous financial statements. In order to audit the accounts payable it requires to use the combination of analytical procedures and tests of detail or substantive audit procedures for accounts payable.

The assertions applicable to Cash Disbursements are. The assertions that concern me the most are completeness occurrence and cutoff. Profit or loss and it differs from country to country as every country has different rules and according to which every country present the income statement of the entity as per norms and.

One high risk of inventory is that the company bought the inventory but the purchases were not recorded into the inventory account. By inspecting the invoice. This includes details collected during an audit that allow an.

When control risk is assessed at high inherent risk becomes the driver of the risk of material misstatement control risk X inherent risk risk of material misstatement.

Audit Expenses Assertions Risks And Procedures Wikiaccounting

Understanding Audit Assertions A Small Business Guide

Inventory Audit Assertions Substantive Tests Youtube

Audit Procedures Types Assertions Accountinguide

Comments

Post a Comment